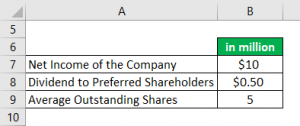

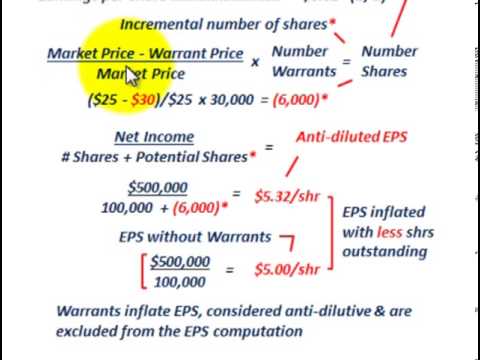

As such, checking only the profit figure in isolation does not give the real earnings potential of the company. Large-cap companies can earn higher profits compared to mid or small-cap companies. Comparison across companies: EPS allows investors to not only compare companies in the same sector but also across all market capitalisations.Here are some significant insights that EPS can give: What is the importance of EPS?ĮPS is a very important figure used by analysts and investors alike to fundamentally analyze a company. the company earned Rs 5 for each share that it has issued. In a quarter if the company earns a profit of Rs 5 lakh, the Earnings Per Share would be Rs 5, i.e. Say a company has issued 1 lakh shares on the stock exchange. The concept of diluted and adjusted EPSĮarnings Per Share, also known as EPS, in short, is the profit earned by a company per unit of its outstanding shares.This is where the concept of earnings per share comes into the picture. Investors should also look at how this earning translates to each share they own.

However, when analysing the financial fundamentals of a company, only looking at the profit earned, in its simplest form, does not depict the company’s true financial health, and potential for future growth.

A company delivering high profits is seen as a stable organisation with the potential to grow and enjoys a high share price on the exchange. A company listed on the stock exchange aims to maximise its profits to keep its shareholders happy.

0 kommentar(er)

0 kommentar(er)